The contribution of Biotechnology to the US Economy

- Marilene Pavan

- Apr 1, 2020

- 4 min read

Updated: Jun 12, 2020

This blog post is heavily based on Carlson, 2016 (1) among other sources, described at the end of this publication.

Even in a developed country as the US it is hard to precisely evaluate the contribution of Biotechnology to its economy. The economic impact of an industry is often based on its contribution to GDP. The way it is measured in the US, is by the federal classification system (North American Industrial Classification System - NAICS). However, the problem with this system is that it lacks the proper definition and codes for the biotech industry, and it is a miscellaneous of oftentimes unrelated technologies. The result, according to Carlson 20161, is that there is at present no means to calculate the contribution of biotech to GDP on the basis of the value added, total income or final sales methods. The best evaluations are based, then, in surveys and reports from public and private offices.

The figures 1 and 2, below, show the revenues obtained by the Biotech industry in 2012 and 2017, divided by subsectors (1,2).

In summary, the results the author found was that the total revenue for the biotech industry is estimated in $324 billion dollars in 2012, though it might be between 10% and 20% higher than that, as this is a conservative analysis. And, from these, the biofuels share is estimated in $9.1 billion dollars. In 2017 this number was at least at $388 billion dollars. Data from 2020 tough report that bio is to be close to $1 trillion dollars now, with a GDP share of approximately 5% already (3). Two percent is already a significant number. For comparison, this is only smaller than construction and chemical products.

The 2012 study also estimated the costs per industry, being the pharmaceuticals the most expensive and time consuming, spending $1 billion dollars per drug and a discovery and commercialization time of approximately 10 years. The we have crops with an expenditure of something in between $500 million and $700 million dollars and a time to develop of approximately 3 to 5 years, and finally the industrial biotech, where we would fit better, with an expenditure of tens to hundred millions to develop and, due especially to the sector low regulation, a relatively fast time to market release. Finally, when you compare different years, the revenue growth of the biotech industry has grown on average at annual rates higher than 10%, and this is more than any other sector, and much faster than the economy indeed.

Specifically, for the synthetic biology market, the sector is expecting a growth from $5 billion dollars in 2019 to more than $18 billion until 2024 (4).

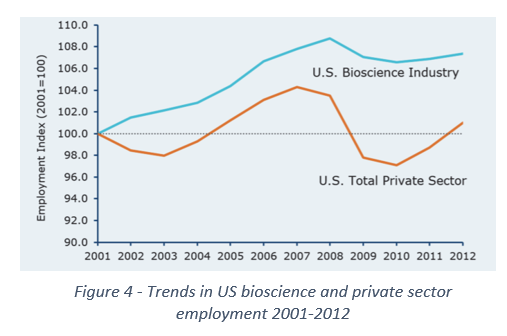

In terms of jobs, wages, and innovation the field seems to be way more robust and stable than the rest of the economy even in moments of crisis. The graph below shows lower losses in the biotech industry compared to the rest of the US economy, even during the 2008 crisis (5).

Compared to other sectors the biotech industry pays much better as well and, in terms of the number of patents being produced the compound annual growth rate in patent activity was of 16.9 percent over the five years. This rapid growth in bioscience patents exceeds overall U.S. patent growth, which is of 11.9 percent compounded annually, over the same period (5).

And which are the risks associated to the potential growth and economic revenue generation associated to the biotech industry? First, investment. The R&D federal funding though is not bad, is being kept flat during the years, at a level of $9 million dollars per year. And we need investment both to understand basic biological precepts and their ultimate translation into bioscience related products and services (5).

Also, the private investment is being kept flat, at least in company’s early stages, at a level of $9 million dollars / year. Again, it is not a bad amount of investment but, if you take into consideration that expenditures are increasing year by year, in a field already costly and risky, it might be a bottleneck soon (5).

Also, regulatory systems need to be improved in a faster way, with the ability to adapt to the new technologies being created. IP regulations need to be reviewed to ensure that we are catching up with newly developed technologies and to better protect the intellectual property being generated in the US, both nationally and internationally.

We also definitively need to be prepared for the impacts the climate change will have over our biotech industry. For example, fluctuations in productivity related to GM crops, as shown by the picture below, for example, might be even worsened by climate change impacts.

All these actions need to be taken soon as the competition in the field is increasing very fast. The global sector growth will demand more biotech tools and technologies and, according to a 2014 report, at least 20 countries have articulated official strategies that explicitly identify biotech as critical to their future economic and employment growth (6).

Finally, but not less important, workforce needs good and fast paced training to attend the fast technological changes and development rates in the field. And, of course, the field would greatly benefit of more diversity in the workforce as well.

Finally, in order to better measure the impact of the Biotech industry over the US economy, and to safeguard the proper usage of it in terms of biosecurity, the main recommendation is to create appropriate metrics to measure its activity and growth. We need to increase the data collection, categorization, and report for the biotech industry. Some of the problems, among others, in not having the correct information of the biotech participation in the US economy is the lack of appropriate data to formulate and advocate for better regulation and resource allocation for research, development, and market incentives (1).

1. Carlson, R. Estimating the biotech sector’s contribution to the US economy. Nat. Biotechnol. (2016). doi:10.1038/nbt.3491

2. Carlson, R. & Agilent. Bioeconomy Capital Dashboard. (2019). Available at: http://www.bioeconomycapital.com/bioeconomy-dashboard.

3. Cumbers, J. & Costa, K. China’s Plan To Beat The U.S. In The Trillion-Dollar Global Bioeconomy. Synbiobeta (2020). Available at: https://synbiobeta.com/chinas-plan-to-beat-the-u-s-in-the-trillion-dollar-global-bioeconomy/.

4. Bergin, J. Synthetic Biology: Global Markets. BCC Research Report Overview 1–13 (2020). Available at: https://cdn2.hubspot.net/hubfs/308401/BIO Report Overviews/BIO066F_Report_Overview.pdf?utm_campaign=BIO066F&utm_source=hs_automation&utm_medium=email&utm_content=80812023&_hsenc=p2ANqtz-8FtCIMv9AuLl6X_g3KDxHau4S6CLejB0SA4agvwz8pcMMxEUbPnfST9q1fGSWQkqwHsUodQqshDgNe-H5OzfHWzUthCxhrVtV1HGhgRaA65DbCLYI&_hsmi=80812023.

5. State Bioscience Jobs, Investments and Innovation. Battelle/BIO (2014). Available at: https://www.bio.org/sites/default/files/legacy/bioorg/docs/files/Battelle-BIO-2014-Industry.pdf.

6. OECD. Emerging Policy Issues in Synthetic Biology. (2014). doi:10.1787/9789264208421-en.

Comments